In this article we will provide you with data on the listed insurance companies across the world. We will show that the costs that occur for standard insurance companies that Black would almost eliminate, are quite significant. We have gathered financial data from various international and Estonian insurance companies between 2013 and 2016. The data shows that administrative expenses are quite high in the industry, thus there is a lot of cost cutting possible. It also becomes clear that smaller insurance companies would be first to fall, as their administrative expenses are relatively high to their gross written premiums.

Insurance companies have costs for admin expenses and net profit of Gross Written Premium. The industry average is 20%.

This is calculated by taking the average sum of the admin and net profit margins data of insurance companies provided below.

Administrative expenses

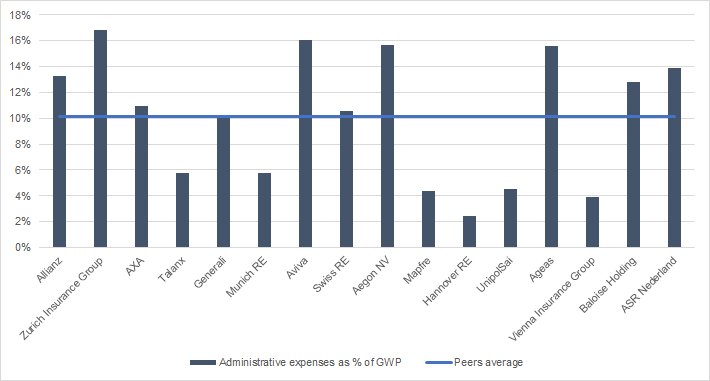

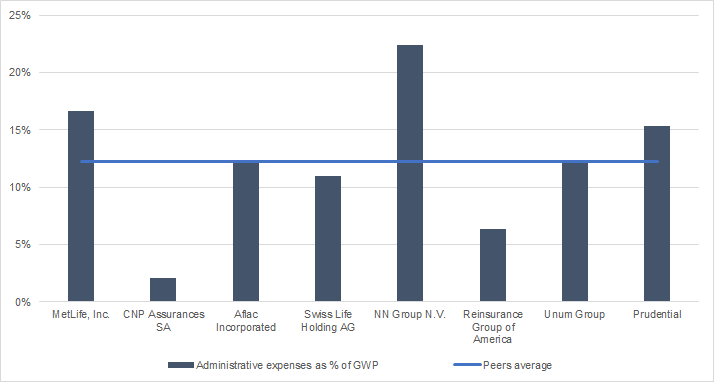

Administrative expenses are mostly related to personnel and office expenses. Whereas most companies provide many types of insurance, we divided companies into two groups: multi-line and life/health insurance. The first group has companies which provide various insurance products, the other group contains companies that mostly focus on life or health insurance.

As for administrative expenses, in multi-line insurance companies, these expenses make up 10% of GWP on average. It is estimated that for Black those costs would be around 5%.

For life and health insurance companies, the result is the same, as administrative expenses make up 12% of gross written premiums.

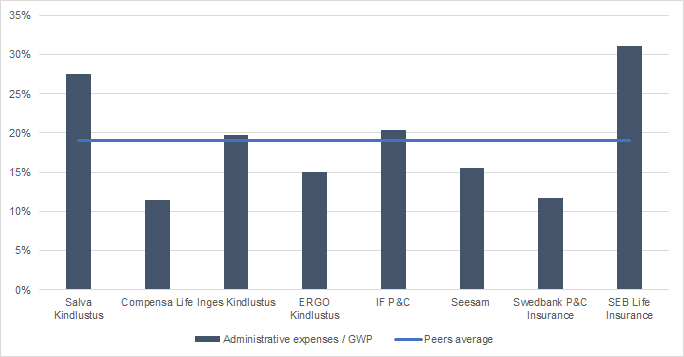

The contrast is quite significant when comparing to the industry’s smaller players. In Estonia, administrative expenses amount to 19% of gross written premiums. Consider that gross written premiums amount to c. EUR 490m in Estonia. That indicates that even small percentages of cost cutting can have an enormous effect on any company.

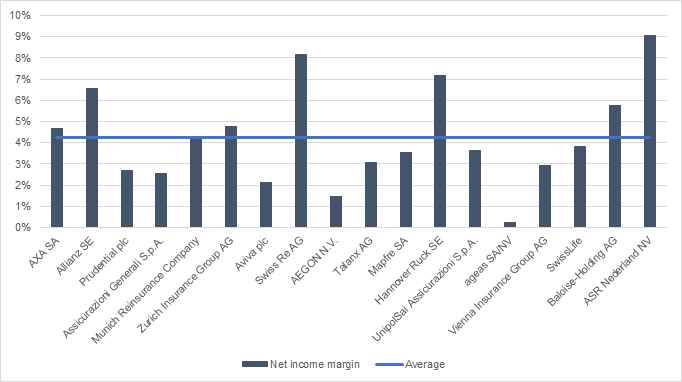

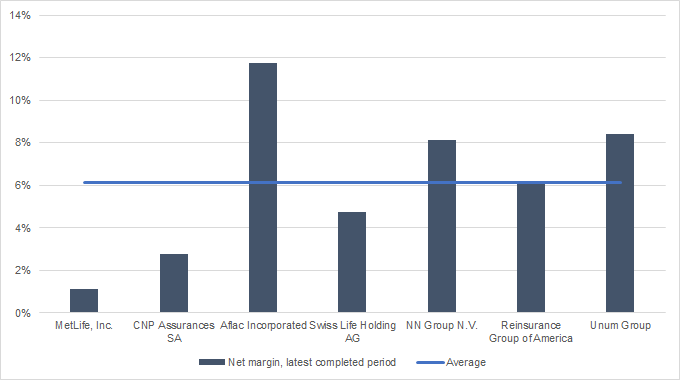

Net margins of the insurance industry’s players

To give a wider picture of the current insurance market, consider the net profit margins of the listed insurance companies. Net margins vary quite significantly between multi-line insurance companies, but none of the peers turned a loss in 2016. The average net margin for the selection of insurance companies is 4.2%.

Margins are slightly higher for insurance companies that focus on life and health insurance, as the net margins for the peers stands at 6.1%.

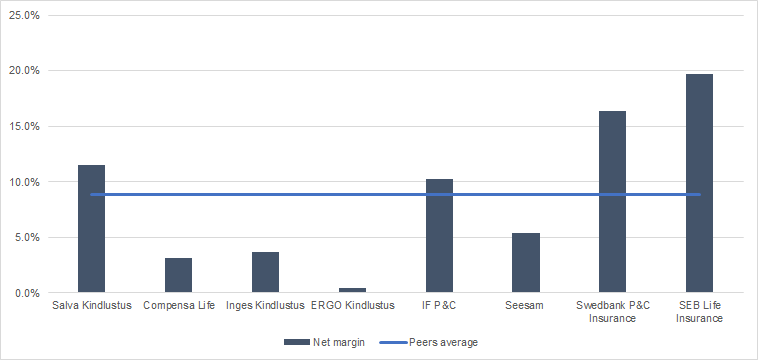

In Estonia, insurance companies manage to be quite profitable, as the average net margin stands at 8.8% for them. It has to be noted though, that Swedbank and SEB are outliers in this case

No comments:

Post a Comment